How to fill out w2 for onlyfans - Help filling out w9 form for OnlyFans : tax

How Many W-2 Forms Do I Need? The amount in tips that your employee reports to you gets placed in box 7, but the actual amount they receive goes in box 8.

All of this information is outlined in detail on the sub or on the onlyfans website already.

Would that make my end of the year tax forms look different? Then you will need to explain to her what you have been doing to make some extra money and why you filed a tax return.

I have created an onlyfans page and I need to fill...

Typically, account users will pair their accounts with twitter, facebook, instagram, snapchat, tumblr, etc.

10 Things to Do When You Sign Up to OnlyFans

The 1099 and W-9 forms go hand in hand.

However, if your gross income from OnlyFans is over £85k i.

Description: If person 1 is solely in control and is a sole proprietor, then person 1 just fires their subcontractor and hires a new one.

User Comments 3

More Photos

Latest Photos

Latest Comments

- +214reps

- What Is a W-2 Form?

- By: Rillings

- +874reps

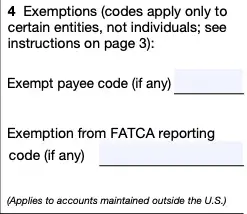

- W-9 Form: Who Has to Fill It Out?

- By: Norwood

- +477reps

- For example, you can insert code B on box 12a.

- By: Fredella

- +798reps

- You are in business for yourself.

- By: Burgener

- +54reps

- Would that make my end of the year tax forms look different?

- By: Pistol

DISCLAIMER: All models on adultdady.pages.dev adult site are 18 years or older. adultdady.pages.dev has a zero-tolerance policy against ILLEGAL pornography. All galleries and links are provided by 3rd parties. We have no control over the content of these pages. We take no responsibility for the content on any website which we link to, please use your own discretion while surfing the porn links.

Contact us | Privacy Policy | 18 USC 2257 | DMCA